New Bookmarks

Year 2009 Quarter 2: April 1 to June 30 Additions to

Bob Jensen's Bookmarks

Bob Jensen at

Trinity University

For

earlier editions of New Bookmarks go to

http://www.trinity.edu/rjensen/bookurl.htm

Tidbits Directory ---

http://www.trinity.edu/rjensen/TidbitsDirectory.htm

Click here to search Bob Jensen's web site if you have key words to enter ---

Search Site.

For example if you want to know what Jensen documents have the term "Enron"

enter the phrase Jensen AND Enron. Another search engine that covers Trinity and

other universities is at

http://www.searchedu.com/.

![]()

Choose a Date Below for Additions to the Bookmarks File

![]()

Bob Jensen's New Bookmarks on

June 30, 2009

Bob Jensen at

Trinity University

For

earlier editions of Fraud Updates go to

http://www.trinity.edu/rjensen/FraudUpdates.htm

For earlier editions of Tidbits go to

http://www.trinity.edu/rjensen/TidbitsDirectory.htm

For earlier editions of New Bookmarks go to

http://www.trinity.edu/rjensen/bookurl.htm

Click here to search Bob Jensen's web site if you have key words to enter ---

Search Box in Upper Right Corner.

For example if you want to know what Jensen documents have the term "Enron" enter the phrase Jensen AND Enron. Another search engine that covers Trinity and other universities is at

http://www.searchedu.com/

Bob Jensen's Blogs ---

http://www.trinity.edu/rjensen/JensenBlogs.htm

Current and past editions of my newsletter called New Bookmarks ---

http://www.trinity.edu/rjensen/bookurl.htm

Current and past editions of my newsletter called

Tidbits ---

http://www.trinity.edu/rjensen/TidbitsDirectory.htm

Current and past editions of my newsletter called Fraud Updates ---

http://www.trinity.edu/rjensen/FraudUpdates.htm

Many useful accounting sites (scroll down) --- http://www.iasplus.com/links/links.htm

Accounting program news items for colleges are posted at

http://www.accountingweb.com/news/college_news.html

Sometimes the news items provide links to teaching resources for accounting

educators.

Any college may post a news item.

Cool Search Engines That Are Not Google --- http://www.wired.com/epicenter/2009/06/coolsearchengines

Bob Jensen's essay on the financial crisis bailout's aftermath and an alphabet soup of

appendices can be found at

http://www.trinity.edu/rjensen/2008Bailout.htm

Federal Revenue and Spending Book of Charts (Great Charts on Bad Budgeting)

---

http://www.heritage.org/research/features/BudgetChartBook/index.html

The Master List of Free Online College Courses --- http://universitiesandcolleges.org/

Free Online Textbooks, Videos, and Tutorials ---

http://www.trinity.edu/rjensen/ElectronicLiterature.htm#Textbooks

Free Tutorials in Various Disciplines ---

http://www.trinity.edu/rjensen/Bookbob2.htm#Tutorials

Edutainment and Learning Games ---

http://www.trinity.edu/rjensen/000aaa/thetools.htm#Edutainment

Open Sharing Courses ---

http://www.trinity.edu/rjensen/000aaa/updateee.htm#OKI

The Master List of Free

Online College Courses ---

http://universitiesandcolleges.org/

Bob Jensen's threads for online worldwide education and training

alternatives ---

http://www.trinity.edu/rjensen/Crossborder.htm

"U. of Manitoba Researchers Publish Open-Source Handbook on Educational Technology," by Steve Kolowich, Chronicle of Higher Education, March 19, 2009 --- http://chronicle.com/wiredcampus/index.php?id=3671&utm_source=wc&utm_medium=en

Social Networking for Education: The Beautiful and the Ugly

(including Google's Wave and Orcut for Social Networking and some education uses

of Twitter)

Updates will be at

http://www.trinity.edu/rjensen/ListservRoles.htm

Humor Between June 1 and June 30. 2009

http://www.trinity.edu/rjensen/book09q2.htm#Humor063009

Humor Between May 1 and May 31, 2009 ---

http://www.trinity.edu/rjensen/book09q2.htm#Humor053109

Humor Between April 1 and April 30, 2009

---

http://www.trinity.edu/rjensen/book09q2.htm#Humor043009

Humor Between March 1 and March 31, 2009 --- http://www.trinity.edu/rjensen/book09q1.htm#Humor033109

Humor Between February 1 and February 28, 2009 --- http://www.trinity.edu/rjensen/book09q1.htm#Humor022809

Humor Between January 1 and January 31, 2009 --- http://www.trinity.edu/rjensen/book09q1.htm#Humor01310100 Greatest Discoveries in Physics ---

http://www.documentary-log.com/d281-100-greatest-discoveries-physics/

Most were important enough to be authenticated before being considered worthy

discoveries

Question

Is empirical accounting research just fun and games generating outcomes not

worth authenticating?

June 17, 2009 message from Richard.Sansing [Richard.C.Sansing@TUCK.DARTMOUTH.EDU]

On Jun 17, 2009, at 9:55 AM, Ron Huefner wrote:

> > > I'm disturbed by the tone of this discussion, implying that most of > accounting research/publication is just a big game.

I think it is fair to say that some members of this group view accounting research as a game, and a rigged one at that. Other members of this group do not share that view. Keeping these different perspectives in mind is helpful when trying to make sense of the discussion.

Richard

June 17, 2009 reply from Bob Jensen

Hi Richard,

I think you're correct Richard, but until academic accountics researchers and their leading journals begin to take replication more seriously, it's very hard to believe in non-replicated harvests of accountics research. Those that are truly serious about accounting research must become more serious about authenticating accounting research.

Perhaps it would seem less of a game if independent researchers took the trouble to replicate findings. On occasion there are some replications (such as the verification of Eric Lie's stock options backdating research), but publication of replications is indeed rare.

It's time for editors of TAR, JAR, JAE, and other leading journals to change their publication policies on replication studies --- http://www.trinity.edu/rjensen/theory01.htm#Replication

Bob Jensen

June 17, 2009 reply from Paul Williams [Paul_Williams@NCSU.EDU]

On 17 Jun 2009 at 9:55, Ron Huefner wrote:

> I'm disturbed by the tone of this discussion, implying that most of > accounting research/publication is just a big game. It seems to demean our

> efforts in a Pogo-like way (we are being our own worst enemy if we don't

> respect our own work). Does some game-playing occur? Undoubtedly. Is it

> the norm? I don't think so (though it's always possible that I'm naive and

> out-of-touch)A Pogo-like way is healthy because Pogo was thoughtful enough to face some realities. I have done considerable work on the structure of the US academy (as has Bob) and the way Bob characterizes it is closer to the truth -- when work deserves to be disparaged, intellectual honesty compels us to disparage it. At an AAA meeting a number of years ago I listened to an editor of one of our most prominent US accounting journals offer the following alternative hypothesis to the one that the academy was structured to advance accounting knowledge: "We have constructed a game to identify who the cleverest people are so we know who to give the money to."

The research on the structure of our academy, if viewed with an open, Pogo-like mind suggests that this alternative hypothesis is more credible than one of being honestly engaged in understanding (if that were the case our research would not be almost entirely structured as tests of conventional economic theories that are constructed not be testable).

I have served numerous times on our university's promotion and tenure committee. I chaired it this past year. I have reviewed the dossiers of people from many disciplines. In the process I have learned quite a bit about the cultures of other disciplines. The discussion about multiple authors, which is the rule in the hard sciences (sometimes there are literally dozens of them), is an interesting contrast. Those disciplines have developed protocols on the order of author listing (it isn't alphabetical) that reflects the relative contributions of the authors to the project.

I've seen people denied tenure because they were not the "lead" author on enough papers. It is a system that is self-reinforcing. Is it abused? Sure, what one isn't, but it seems to work reasonably well. Accounting has no such protocol. At my shop we have reached the point where the same credit is given to a person on a three-author paper as is given to a person with a single authored paper. Without the protocol that exists in the natural sciences on credit for multiple authors, there is little other way to describe our process as other than a game.

Another protocol in the laboratory or bench sciences is the maintenance of a lab journal. You can always spot a lab scientist at our faculty senate meetings because they are the people taking notes in a bound journal (a diary). Because replication is crucial to science, there is a moral imperative that an experimental scientist keep a precise record of each step in the experimental process. He or she must provide the exact recipe so that any scientist is able to produce the result. (One of the most interesting studies of the sociology of science involved the lab journals of Millikin reporting his various iterations of the oil-drop experiment; guess which ones he published -- you guessed it -- the ones most consistent with his prior beliefs.

Without those lab journals, this knowledge would be lost forever). Most of the work published in our leading accounting journals is laboratory work (accountics, as Bob describes it). Data are gathered (usually selected from a publicly available data source) and all manner of choices are made by the experimenter in conducting the experiment before the final published result is obtained. For example, do we know what truncation decisions were made or how many different models were run before the published one arose? But we have no requirement that the experimenter keep a detailed log of all of these choices. We have to rely on the recipe given in the article itself, which is seldom sufficient to replicate what was actually done.

When Bill Cooper suggested that the AAA require authors publishing in TAR to provide their data (not their logs, because they don't have them) to the public, our noted accounting scientists screamed bloody murder. We still have only a voluntary disclosure policy. If we were truly serious about learning something from our work, we would mandate that sufficient information be provided to allow anyone to replicate the experiments before we publishe the results. That we don't do that may say something about us.

For the interested: Adil E. Shamoo and David B. Resnik, Responsible Conduct of Research, 2003, Oxford University Press. I took a course in this taught by one of NC State's philosophers. There is a huge literature on appropriate research conduct in the sciences (social and natural). In accounting there is practically none. For a discipline whose alleged expertise is "controls" we have virtually none over the research process. Guess we are all saints.

Paul Williams paul_williams@ncsu.edu

(919)515-4436

June 17, 2009 reply from Roger Collins [rcollins@TRU.CA]

Paul,

Thanks for an excellent post. For those interested, the Shamoo and Resnik text you mention is now into its second edition

Adil E. Shamoo and David B. Resnik, Responsible Conduct of Research # Paperback: 440 pages # Publisher: Oxford University Press; Second Edition edition (Feb 24 2009) # Language: English # ISBN-10: 019536824X # ISBN-13: 978-0195368246

Roger

Roger Collins

TRU School of Business & Economics

June 20, 2009 reply from David Albrecht [albrecht@PROFALBRECHT.COM]

To be clear about what I think (as if anybody cares), I think that a substantial amount of game playing takes place, but accounting research itself does not need to be characterized as a game. I believe that (1) there are many incentives to manipulate the system for personal gain, (2) many accounting professors participate in the system and play games because they are forced to participate and game playing seems to be efficient and effective, and (3) there are enough ethically challenged amongst the accounting professoriate to justify a general world view of skepticism.

Dave Albrecht

June 20, 2009 reply from Bob Jensen

Hi David,

I wish I could repeat some private messages I'm receiving from accounting professors about (ratting?) how some of their colleagues are gaming the research/publishing system.

Most mention a 99-1 model or its near-equivalent. Others mention the 98-1-1 model. The worst is a message revealing a 94-1-1-1-1-1-1-model.

Of course I believe many, probably most, joint authoring efforts are legitimate for reasons astutely mentioned by Ron Huefner. But there also is a lot a gaming going on.

Paul Williams notes that at every juncture empirical accounting researchers make subjective decisions that make it almost impossible to truly replicate outcomes. In a private message he notes that a top researcher (who chaired a lot of doctoral dissertations) made an on-campus presentation in which he admitted to 16 times in his research study being presented where he made decisions that would've made it virtually impossible to independently replicate his work. The source of the data was a commercial database that can be purchased by anybody, but it alone would not have been sufficient for research outcomes authentication.

It would seem that if the top research journals announced a change in policy and invited submissions of research replications there might be few submissions that actually authenticate earlier published outcomes. Until accounting researchers commence keeping "lab journal" (and making them available to teams of authentication researchers) I doubt that there will be serious replication of empirical academic accounting research. Until then we must, in the words of Paul Williams, regard our empirical accounting researchers as "saints."

What's more disheartening are reports of failed efforts to replicate the empirical results of some of the AAA's Seminal and/or Notable contributions award winners. The makes me wonder if another type of gaming (selectively massaging of data) is going on at the highest level of prestige in academic accounting research.Bob Jensen

June 20, 2009 reply from Jagdish Gangolly [gangolly@GMAIL.COM]

Bob,

1. Free ridership should bother the culprit more than the rest. The culprit will establish a reputation and soon the number of people willing to collaborate with the person will dwindle.

Unless of course, the person also establishes reputation as a saint. I have heard of many free-riding saints in accounting.

2. I think requiring publicly disclosed lab journal is a very good idea. I also favour replications, provided the design of each original as well as replicated study is authenticated by a statistician and a domain expert (economics, finance, psychology,...). Some adult supervision may not be a bad idea if we are unwilling to seek collaborations with other disciplines.

3. I personally believe a good solution for accounting is a Darwinian one: Shut down all establishment journals and let the "market" decide. The fittest results will survive in the long run. Establishment journals are riddled with moral hazard in the absence of observability and replications. This solution will also prevent the development of ayatollahs pretending to be editors and referees. (Of course there are many good editors and referees, but they are, in my opinion exceptions). Sunshine is a good disinfectant.

I say the above in spite of the fact that my own personal experience has not been that bad (most papers I chose to send to accounting journals were accepted, but many of the inane comments even on papers accepted and the fact that some were accepted in spite of their mediocrity drive me to this conclusion).

Regards,

Jagdish S. Gangolly

Department of Informatics College of Computing & Information

State University of New York at Albany Harriman Campus,

Building 7A, Suite 220

Albany, NY 12222

Phone: 518-9568251

Bob Jensen's threads on the history what's wrong with academic accounting

research are at

http://www.trinity.edu/rjensen/395wpTAR/03MainDocumentMar2007.htm

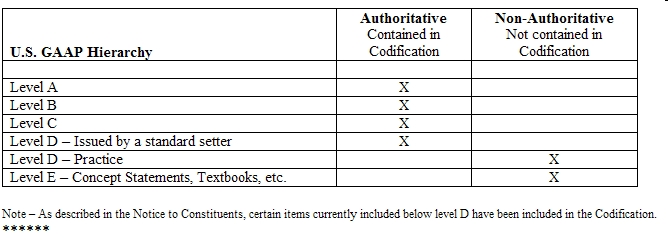

FASB Codification Database Supersedes All FASB Standards

Countdown to Codification Alert: FASB Alert #4, 5-22-09

What happens to U.S. GAAP literature when the Codification goes live on July 1,

2009?

All

existing standards that were used to create the Codification will become

superseded upon the adoption of the Codification. The FASB will no longer

update and maintain the superseded standards. Also, upon adoption of the

Codification, the U.S. GAAP hierarchy will flatten from five levels to

twoauthoritative and non-authoritative. The following table illustrates the

result:

DON’T BE CAUGHT OFF GUARD! GET READY FOR THE CODIFICATION!

The FASB is expected to institute a major change in the way accounting standards

are organized. The FASB Accounting Standards CodificationTM is

expected to become the single official source of authoritative, nongovernmental

U.S. generally accepted accounting principles (GAAP). After final

approval by the FASB only one level of authoritative GAAP will exist, other than

guidance issued by the Securities and Exchange Commission (SEC). All other

literature will be non-authoritative.

While the FASB Codification is designed to make it much easier to research

accounting issues, the transition to use of the Codification will require some

advance training. These weekly “Countdown to Codification” alerts are designed

to provide tips to make that transition easier.

The FASB offers a free online tutorial at

http://asc.fasb.org. A recorded instructional webcastThe Move to

Codification of US GAAP, first presented live on March 13, 2008also is

available at

http://www.fasb.org/fasb_webcast_series/index.shtml. In addition,

Codification training opportunities are offered through professional accounting

organizations such as the American Institute of Certified Public Accountants (AICPA).

As of June 20, 2009 there is still some question whether faculty, students, and colleges will get the a free deal on the $150 basic version or the $850 professional version that includes cross referencing.

The following message was forwarded by David Albrecht on June 16, 2009

From: "Tracey E. Sutherland" <traceysutherland@aaahq.org>

Organization: American Accounting Association

Date: Tue, 16 Jun 2009 17:25:23 -0400

FAF and AAA to Provide FASB Codification to Faculty and Students

On July 1, 2009, the Financial Accounting Standards Board (FASB) is instituting a major change in the way accounting standards are organized. On that date, the FASB Accounting Standards Codification™ (FASB Codification) will become the single official source of authoritative, nongovernmental U.S. generally accepted accounting principles (U.S. GAAP). After that date, only one level of authoritative U.S. GAAP will exist, other than guidance issued by the Securities and Exchange Commission (SEC). All other literature will be non-authoritative.

As part of its educational mission, the Financial Accounting Foundation (FAF), the oversight and administrative body of the FASB, in a joint initiative with the American Accounting Association (AAA), will provide faculty and students in accounting programs at post-secondary academic institutions with the Professional View of the online FASB Codification.

Accounting Program Access—No Cost to Individual Faculty or Students

The Professional View of the FASB Codification will be accessible at no cost to individual faculty and students, through the AAA’s Academic Access program, available to Registered Accounting Programs. The Professional View will provide advanced search functions with special utilities to assist in the navigation of content, representing the fully functional view of the FASB Codification that will be used by auditors, financial analysts, investors, and preparers of financial statements. All of the features that have been available with the verification version currently at http://asc.fasb.org are included with the Professional View.

AAA Academic Access

The AAA will provide direct services to accounting departments through its Academic Access program; issuing authentication credentials for faculty and students through Registered Accounting Programs, at a low annual institutional fee of $150. Information about this program will be forthcoming directly from AAA and on the AAA website at http://aaahq.org/FASB/Access.cfm.

Transitional Access—From July 1 through August 31, 2009

The AAA will provide credentials to individual faculty and students, at no charge, during the transition period before the beginning of the fall semester when faculty and students will receive credentials for access through their Registered Accounting Programs.

The FAF, FASB, and AAA are enthusiastic about this new initiative and understand the value of this program to accounting education and scholarship, in addition to its benefit to faculty and students to have access to the advanced view of U.S. GAAP that will be used by accounting professionals.

******************

This advertisement was sent to you from the American Accounting Association. This message includes valuable information about upcoming events hosted by the American Accounting Association. If you no longer want to receive email announcements from us, please send an email to office@aaahq.org with "EMAIL OPT-OUT" in the subject line.

American Accounting Association | 5717 Bessie Drive | Sarasota, FL 34233-2399 | Phone: (941) 921-7747 | Fax: (941) 923-4093 | Office@aaahq.org

The FASB home page is at http://www.fasb.org/home

June 24, 2009 Update

There was some doubt initially about whether the free or discounted faculty

and student access version of the FASB Codification database would be the

"Professional" version (that includes searching and cross-referencing at an $850

single user license per year).

The AAA registration site for the discounted ($150 annual discount price) version makes it clear that accounting education departments or schools will get the full "Professional" version at a discount, thereby saving each academic program $700 per year savings per license. What is not yet perfectly clear is whether this is a single-user access license. My reading is that multiple users within a department or school can use the Codification database at the same time. I could be wrong.

The AAA program enrollment site for this discounted version is

http://aaahq.org/FASB/Access.cfm

The form is at

https://aaahq.org/AAAforms/FASB/enroll.cfm

Since all future financial statements will no longer reference hard copy sources like FAS 166 or EITF 98-1 or FIN 48, it is vital for students and teachers and researchers to have access to the Codification database for financial statement analysis.

Reasons why registration for the Codification database is important are

given at

http://www.cfo.com/article.cfm/13854787/c_2984368/?f=archives

Also see

http://www.trinity.edu/rjensen/theory01.htm#MethodsForSetting

June

25, 2009 Update

Bad News

The AAA program enrollment site for this discounted version is

http://aaahq.org/FASB/Access.cfm

The form is at

https://aaahq.org/AAAforms/FASB/enroll.cfm

And if a college library pays $850 for a license, the Codification database can

only be used by one user at a time.

Good News

An Accounting Education Department’s $150 license can be used by multiple

faculty members and students simultaneously, which is indeed good news.

It’s not yet clear how an accounting department will facilitate multiple-user access, but I guess we will learn that very soon. For example how can students and faculty off campus access the $150 professional version of the Codification database.

Reasons why a Department’s enrollment for the Codification database is important are given at http://www.cfo.com/article.cfm/13854787/c_2984368/?f=archives

Codification: Dumb! Dumb! Dumb!

Codification of the FASB standards, interpretations, and other hard copy FASB documentation into a searchable "Codification" database, like the road to hell, is paved with good intentions. Bits and pieces of hard copy dealing with a given topic are scattered in many different hard copy FASB references and bringing this all together in newly coded Codification numbered sections and subsections is a fabulous "paving" idea.

FASB News Release --- Click Here

Just to see how important this is for accounting and finance students as well as faculty, go to

http://www.cfo.com/article.cfm/13854787/c_2984368/?f=archivesAlso see http://www.journalofaccountancy.com/Web/July1Codification

And see http://www.journalofaccountancy.com/Web/Codification

At least Codification of FASB hard copy was a great "paving" idea until it became evident that FASB standards most likely will be entirely replaced by IASB international standards (IFRS). It's still uncertain when and if IFRS will replace the FASB standards, but recent events in Washington DC suggest that the transition will most likely happen at the end of 2014. This means that millions of dollars and millions of professional work time hours by accountants, auditors, educators, and financial analysts will be spent using the FASB's new Codification database that commenced on July 1, 2009 and will most likely self destruct on December 31, 2014. As I indicated, when and if IFRS will take over is still uncertain and controversial, but I'm betting the shiny new FASB Codification database will self destruct in 2014 --- http://www.trinity.edu/rjensen/theory01.htm#MethodsForSetting

As a result of scheduled obsolescence, what commenced as a Codification smart idea became dumb and dumber in 2009.

Furthermore, the Codification database has some huge limitations because it contains only a subset of the FASB hard copy material that it ostensibly is replacing.

I’ve been

using the Codification database rather intensively on a FAS 133 project

since it became available. I can’t tell you how disappointed I am in content

of the database, the lousy illustrations, and the poor search engine. The

IASB search engine is vastly superior. Dumb! Dumb! Dumb!

So what would've been smart for the FASB at this juncture?

Since the FASB is taking it as a given that it will virtually be out of business

in 2015 (actually it will become a downsized subsidiary of the IASB). The FASB

should forget implementation (selling) the FASB Codification database and

commence full bore into expanding it into an IASB Codification database. Then it

will be ready to roll in 2015 when the IASB standards replace the FASB

standards. FASB standards could be left codified as well such that users can

easily compare what used to be required by the FASB with what is now (after

2015) required by the IASB.

More importantly, the FASB should work 24/7 adding implementation guidelines and illustrations into an IASB Codification database to make up for the sad state of international standards in terms of implementation guidelines for complex U.S. financial contracting. Tons of illustrations should also be added to the illustration-lite international standards at the moment.

But implementing the FASB Codification database for five years or less is dumb, dumb, and dumb!

"I'm glad I'm not young anymore."

June 28, 2009 reply from Louis Matherne [matherne@OPTONLINE.NET]

Bob,

I don't agree with the following...

"... This year early adopters of XBRL who tagged their financial statements with FASB hard copy references will be putting out obsolete XBRL tagging. All the U.S. standard XBRL tagging software and financial analysis software will have to be rewritten..."

While there will undoubtedly be some impact to the current USGAAP taxonomies, I expect it to be minimal. The references that are currently in the taxonomy are largely in sync with their codification replacements as the FAF and XBRL US have been working on this expected transition for some time.

From a mechanical point of view it will be a fairly simple exercise to "slip stream" in the codification references.

Louis

June 28, 2009 reply from Zane Swanson [ZSwanson@UCO.EDU]

Askaref (which I developed with 2 others) is designed for handheld internet devices to do that cross-referencing between line item accounts, XBRL tags, and GAAP references (FASBs, etc). Having gone through the database machinations to make this function work, I would say that effort is nontrivial, but not rocket science. Until I see what a official release of the XBRL tagging for the Codification, I would suggest that blanket statements are premature about the ease to “slip stream” references or the rendering of databases as useless. In any event, it will make users and support individuals mad if this feature is delayed … like the Boeing 787 dreamliner (the launch date keeps getting delayed and there is a corresponding loss of value). With respect to XBRL tagging errors being generated by the inclusion of Codification, it is difficult to get into the mind of the user/preparer who is selecting the “best match” of a XBRL tag with an accounting line item. I do agree that referencing the appropriate GAAP is critical in order to select the “best match” of an XBRL tag. If this referencing activity is made more difficult or has incomplete links, then it is logical that more errors will occur.

With regard to textbooks, one fix that I have seen is a cross reference table which lists textbook pages and their FASB references with the Codification references. Hardly elegant, but it works.

Zane Swanson

June 28, 2009 reply from Bob Jensen

Hi Louis

I was influenced by the following quotation that does not make it sound so slip stream and mechanical as firms struggle to update the XBRL tags:

Any company with a scheduled filing date before July 22 for a quarter ending June 15 or later can opt to file its report using the out-of-date 2008 taxonomy. The SEC, though, is encouraging filers to use the current set of data tags. To accommodate that request, a company with a line item affected by new FASB literature will have to create its own extensions to the core taxonomy. Not only would that require extra effort by companies, Hannon lamented that "a bunch of rogue XBRL elements" not formed the same way from company to company would inevitably hinder analyses of the effect of FASB's new pronouncements on financial statements.

David McCann, "Speed Bumps for Early XBRL Filers, Users," CFO.com, June 26, 2009 ---

http://www.cfo.com/article.cfm/13932485/c_2984368/?f=archivesI hope you are correct because it will be a race to update all the tagging software and implement these tags in corporate annual reports before the FASB Codification archive database self destructs.

Another problem is that companies that are affected by FAS 133 often refer to DIGG documents that will not be updated for Codification references. This could lead to rather confusing outcomes where a footnote quotation from a DIGG refers to Paragraph 243 of FAS 133 and the XBRL tag refers to Section 8-15-38 of the Codification database that is not part of the DIGG document.. It will be especially troublesome with FAS 133 since there is so much FAS 133 hard copy that was left out of the Codification database such that searches and references of the database cannot even find many hard copy references originally issued by the FASB.

I don't think it's as easy as you make it sound and for what purpose with an archival database that will most likely self destruct in such a relatively short period of time?

Thanks,

Bob Jensen

Bob Jensen's threads on the controversies of accounting standard setting are at http://www.trinity.edu/rjensen/theory01.htm#MethodsForSetting

Bob Jensen's free tutorials on FAS 133, IAS 39, and DIGG pronouncements

are at

http://www.trinity.edu/rjensen/caseans/000index.htm

From IAS Plus on June 3, 2009 ---

http://www.iasplus.com/index.htm

July 3 and July 6 Webcasts on IAS 39 Replacement

On Friday 3 July 2009 and again on Monday 6 July 2009, the IASB will host two live webcasts to keep interested parties up to date on progress of the IASB's comprehensive project to replace IAS 39. The webcasts will focus on the Board's recently published Request for Information on the feasibility of an expected loss model. The webcasts will include presentations by two IASB project staff people followed by a Q&A session where registered participants can send in questions for the IASB staff to answer. Each webcast, including the question and answer session, is expected to last around one hour. Details of the webcasts:

- Webcast Topic: Project to comprehensively review IAS 39 – Expected loss impairment model

- Date and Time - First Webcast: Friday 3 July 2009 10:00am (London time)

- Date and Time - Second Webcast: Monday 6 July 2009 3:00pm (London time)

- Presenters: Sue Lloyd, Senior Technical Consultant and Martin Friedhoff, Project Manager

- More Information and Registration

- Project Page on IASB Website

- Project Page on IAS Plus

Questions

Didn't anybody think that the FASB's new Codification transition would render

XBRL markups obsolete even before they got off the ground? What about financial

accounting textbooks for next year and the CPA examination?

Answer

I'm certain somebody thought about it, but nobody wanted to shut off this train

smoke on the Codification transition commencing July 1, 2009

There is also the issue that virtually all financial accounting textbooks purchased by students for the 2009-2010 academic year will be obsolete (I suspect). Such is life in the fast lane. When will the CPA examination gulp down the Codification references?

And the Codification transition in 2009 is such a spike in cost and confusion given that it will probably itself be obsolete around 2014 or thereabouts when it is replaced by IFRS. Such is life in the fast lane where CEP providers and software writers and publishers are singing (the stink being train smoke as standard setters railroad in the changes on express trains):

Ca-chink, ca-chink,

We're getting rich on all this stink!"

"Speed Bumps for Early XBRL Filers, Users," by David McCann, CFO.com,

June 26, 2009 ---

http://www.cfo.com/article.cfm/13932485/c_2984368/?f=archives

A solution is said to be coming soon to a thorny technical issue that had threatened to temporarily render electronic financial reports tagged in eXtensible Business Reporting Language less useful than had been hoped.

The source of the problem is the Financial Accounting Standards Board's new codification of accounting standards, which is set to take effect July 1. One key advantage of XBRL-prepared electronic reports is that each data-tagged line item displays references to the accounting and regulatory rules applicable to that item. That gives users of the financial statements valuable context for the reported number.

But the current XBRL taxonomy — that is, the set of tags corresponding to the line items — aligns with the pre-codification organization of the FASB literature. That means that as of July 1, users of data-tagged reports will see references to standards that don't match up with the new codification. A new taxonomy incorporating references to the newly codified accounting rules is not expected to be released until early 2010.

Neither FASB nor the non-profit entity that is working to establish XBRL as a financial reporting format in the United States had announced whether or when a temporary fix for the problem would be made available. But yesterday, Mark Bolgiano, chief executive of XBRL US, told CFO.com that one would be ready in July. The two organizations are working together, he said, to create an extension to the existing 2009 taxonomy that will display the references correctly.

FASB, though, hedged a bit on the July timeframe. A spokesperson told CFO.com that the accounting standards board is "shooting" to have the fix ready by the end of the month, but there is no specific scheduled date.

Even a short delay could affect investors, banks, and other users of financial statements filed by any of the 500 largest public companies with fiscal periods ending June 30 — that is to say, most of them. And to the extent there is any confusion about the accounting underlying the information in the reports, it could, of course, could cause some communications problems for finance executives. The Securities and Exchange Commission earlier this year required those 500 companies to file financials using XBRL for periods ending June 15 of this year and later. (About 1,800 more companies have to do so starting with quarters concluding on or after June 15, 2010, with the rest following a year after that.)

In fact, a late-July or later release of the fix would likely mean that most of the first wave of XBRL filings — after those by a small group of voluntary early adopters that included Microsoft and Pepsico — would contain the incorrect references, according to Neal Hannon, senior consultant for XBRL strategies at The Gilbane Group, an information technology consulting firm.

Everybody involved in the production of financial reports, Hannon said, including software companies and financial printers, will need some time to understand the solution and make sure it's compatible with their products, before companies can begin to prepare financials containng references to the codification accounting standards.

Still, Hannon called the forthcoming solution "great news," saying he had been concerned for months that the necessary programming might not prove doable, at least in a reasonable time frame. He characterized XBRL-tagged financial reports without references to the current underlying accounting literature as unacceptable. "What would be the point?" he said.

Even if the fix were delayed, financial-report users would still be able to locate the accounting standards relating to specific line items, according to Tom Hoey, FASB's codification project director. The board's codification website contains a tool that cross-references the old organization of generally accepted accounting principles with the new one. "It's not as though people have to be completely lost," Hoey said, but added, "they might find it more cumbersome for a short period."

Indeed, Hannon noted that a user would have to run two programs simultaneously, switching back and forth between an XBRL software reader and the cross-reference tool, which he said would be somewhat unwieldy when performing robust analyses of financial statements.

Meanwhile, there is another speed bump for the early days of XBRL filings: The SEC's Edgar filing database will not be ready to accept data-tagged reports using the 2009 taxonomy, containing several FASB rules and interpretations published this year, until July 22.

Any company with a scheduled filing date before July 22 for a quarter ending June 15 or later can opt to file its report using the out-of-date 2008 taxonomy. The SEC, though, is encouraging filers to use the current set of data tags. To accommodate that request, a company with a line item affected by new FASB literature will have to create its own extensions to the core taxonomy. Not only would that require extra effort by companies, Hannon lamented that "a bunch of rogue XBRL elements" not formed the same way from company to company would inevitably hinder analyses of the effect of FASB's new pronouncements on financial statements.

Continued in article

Bob Jensen's XBRL threads (and free tutorial videos) are at

http://www.trinity.edu/rjensen/XBRLandOLAP.htm

Bob Jensen's threads on standard setting controversies are at

http://www.trinity.edu/rjensen/theory01.htm#MethodsForSetting

"The Best Online Tools (software, services) for Personal Finance," by Shelly Banjo, The Wall Street Journal, June 8, 2009 --- http://www.trinity.edu/rjensen/PersonalFinanceTools.htm

1. Budgeting Your Money

2. Creating a Financial Plan

3. Tracking Investments and Getting Advice

4. Checking for Fraud

5. Keeping Track of Credit

6. Managing Loans

Details at http://www.trinity.edu/rjensen/PersonalFinanceTools.htm

PBS Television will now answer

your personal finance questions ---

http://www.pbs.org/newshour/insider/business/jan-june09/pocketchange_05-05.html

"Feed the Pig" is the AICPA's terrible name for its free site for helping

people with personal finances

http://www.aicpa.org/financialliteracy/FeedThePig/

"New Feed the Pig Curriculum Targets Younger Audience,

Journal of Accountancy,

December 2008 ---

http://www.journalofaccountancy.com/Issues/2008/Dec/NewFTPTargetsYoungerAudience.htm

Bob Jensen's helpers for personal finance ---

http://www.trinity.edu/rjensen/Bookbob1.htm#InvestmentHelpers

Bob Jensen's threads on Accounting Software ---

http://www.trinity.edu/rjensen/Bookbob1.htm#AccountingSoftware

The Worldcom fraud accompanied by one of the largest bankruptcies is characterized by what, in my viewpoint, was the worst audit in the history of the world that contributed, along with Enron, to the implosion of the historic Arthur Andersen accounting firm.

KPMG’s “Unusual Twist”

While KPMG's strategy isn't uncommon among corporations with lots of units in

different states, the accounting firm offered an unusual twist: Under KPMG's

direction, WorldCom treated "foresight of top management" as an intangible asset

akin to patents or trademarks.

See http://www.trinity.edu/rjensen/FraudEnron.htm#WorldcomFraud

Punch Line

This "foresight of top management" led to a 25-year prison sentence for

Worldcom's CEO, five years for the CFO (which in his case was much to lenient)

and one year plus a day for the controller (who ended up having to be in prison

for only ten months.) Yes all that reported goodwill in the balance sheet of

Worldcom was an unusual twist.

June 15, 2009 message from Dennis Beresford [dberesfo@TERRY.UGA.EDU]

I apologize if this is something that has already been mentioned but I just became aware of a very interesting video of former WorldCom Controller David Meyers at Baylor University last March - http://www.baylortv.com/streaming/001496/300kbps_str.asx

The first 20 minutes is his presentation, which is pretty good - but the last 45 minutes or so of Q&A is the best part. It is something that would be very worthwhile to show to almost any auditing or similar class as a warning to those about to enter the accounting profession.

Denny Beresford

Jensen Comment on Some Things You Can Learn

from the Video

David Meyers became a convicted felon largely because he did not say no when

his supervisor (Scott Sullivan, CFO) asked him to commit illegal and

fraudulent accounting entries that he, Meyers, knew were wrong.

Interestingly, Andersen actually lost the audit midstream to KPMG, but KPMG

hired the same same audit team that had been working on the audit while

employed by Andersen. David Myers still feels great guilt over how much he

hurt investors. The implication is that these auditors were careless in a

very sloppy audit but were duped by Worldcom executives rather than be an

actual part of the fraud. In my opinion, however, that the carelessness was

beyond the pale --- this was really, really, really bad auditing and

accounting.

At the time he did wrong, he rationalized that he was doing good by shielding Worldcom from bankruptcy and protecting employees, shareholders, and creditors. However, what he and other criminals at Worldcom did was eventually make matters worse. He did not anticipate this, however, when he was covering up the accounting fraud. He could've spent 65 years in prison, but eventually only served ten months in prison because he cooperated in convicting his bosses. In fact, all he did after the fact is tell the truth to prosecutors. His CEO, Bernard Ebbers, got 25 years and is still in prison.

The audit team while with Andersen and KPMG relied too much on analytical review and too little on substantive testing and did not detect basic accounting errors from Auditing 101 (largely regarding capitalization of over $1 billion expenses that under any reasonable test should have been expensed).

Meyers feels that if Sarbanes-Oxley had been in place it may have deterred the fraud. It also would've greatly increased the audit revenues so that Andersen/KPMG could've done a better job.

To Meyers' credit, he did not exercise his $17 million in stock options because he felt that he should not personally benefit from the fraud that he was a part of while it was taking place. However, he did participate in the fraud to keep his job (and salary). He also felt compelled to follow orders the CFO that he knew was wrong.

The hero is detecting the fraud was Worldcom's internal

auditor Cynthia Cooper who subsequently wrote the book:

Extraordinary Circumstances: The Journey of a Corporate Whistleblower

(Hoboken, New Jersey: John Wiley & Sons, Inc.. ISBN 978-0-470-12429)

http://www.amazon.com/gp/reader/0470124296/ref=sib_dp_pt#

Meyers does note that the whistleblower, Cooper, is now a hero to the world, but when she blew the whistle she was despised by virtually everybody at Worldcom. This is a price often paid by whistleblowers --- http://www.trinity.edu/rjensen/FraudConclusion.htm#WhistleBlowing

Bob Jensen's threads on the Worldcom fraud are at http://www.trinity.edu/rjensen/FraudEnron.htm#WorldcomFraud

KPMG Should Be Tougher on Testing, PCAOB Finds The Big Four audit firm was

cited for not ramping up its tests of some clients' assumptions and internal

controls

KPMG did not show enough skepticism toward clients

last year, according to the Public Company Accounting Oversight Board, which

cited the Big Four accounting firm for deficiencies related to audits it

performed on nine companies. The deficiencies were detailed in an inspection

report released this week by the PCAOB that covered KPMG's 2008 audit season.

The shortcomings focused mostly on a lack of proper evidence provided by KPMG to

support its audit opinions on pension plans and securities valuations. But in

some instances, the firm was cited for weak testing of internal controls over

financial reporting and the application of generally accepted accounting

principles.

Marie Leone, CFO.com, June 19, 2009 ---

http://www.cfo.com/article.cfm/13888653/c_2984368/?f=archives

In one instance, the audit lacked evidence about whether the pension plans contained subprime assets. In another case, the PCAOB noted, the audit firm didn't collect enough supporting material to gain an understanding of how the trustee gauged the fair values of the assets when no quoted market prices were available.

The PCAOB, which inspects the largest public accounting firms on an annual basis, also found that three other KPMG audits were shy an appropriate amount of internal controls testing related to loan-loss allowances, securities valuations, and financing receivables.

In one audit, KPMG accepted its client's data on non-performing loans without determining whether the information was "supportable and appropriate." In another case, KPMG "failed to perform sufficient audit procedures" with regard to the valuation of hard-to-price financial instruments.

In still another case, the PCAOB found that KPMG "failed to identify" that a client's revised accounting of an outsourcing deal was not in compliance with GAAP because some of the deferred costs failed to meet the definition of an asset - and the costs did not represent a probably future economic benefit for the client.

KPMG’s “Unusual Twist”

While KPMG's strategy isn't uncommon among corporations with lots of units in

different states, the accounting firm offered an unusual twist: Under KPMG's

direction, WorldCom treated "foresight of top management" as an intangible asset

akin to patents or trademarks.

See http://www.trinity.edu/rjensen/FraudEnron.htm#WorldcomFraud

Punch Line

This "foresight of top management" led to a 25-year prison sentence for

Worldcom's CEO, five years for the CFO (which in his case was much to lenient)

and one year plus a day for the controller (who ended up having to be in prison

for only ten months.) Yes all that reported goodwill in the balance sheet of

Worldcom was an unusual twist.

Integrity is a cornerstone

of our culture and we continue to make great progress in our effort to

build a model ethics and compliance program. This means fostering

awareness, trust, and personal responsibility at every level of the

firm. This year, we issued our first ever ethics and compliance progress

report and guidebook. This report,

Ethics and Compliance Report 2007: It Starts with You,

highlights initiatives that we have in place to

support our values-based compliance culture, and features real-life

stories of some of KPMG's partners and employees who faced ethical

challenges and how they handled them. We responded to heightened

interest in ethics education and input from your fellow academics and

created our KPMG Ethical Compass—A

Toolkit for Integrity in Business, a three-module package of

classroom materialsto help you present ethics-related topics to your

students.

An Open Letter From Tim Flynn, Chairman and CEO, KPMG LLP

This was part of an email message that I assume was sent to

the academy of accountants.

Once again the link to the Ethics and Compliance Report 2007 is at http://www.kpmgcampus.com/whoweare/ethics.pdf

Bob Jensen's threads on the "Two Faces of KPMG" ---

http://www.trinity.edu/rjensen/fraud001.htm

"PCAOB Rips E&Y on Revenue Recognition: Two of Ernst & Young's clients had to restate financial results after the accounting-firm overseer found departures from GAAP," by Sarah Johnson, CFO.com, May 27, 2009 --- http://www.cfo.com/article.cfm/13725058/c_13725042

Ernst & Young failed to note when two clients strayed from revenue-recognition rules, according to the latest inspection report on the Big Four firm by the Public Company Accounting Oversight Board. Consequently, the regulator's sixth annual inspection of E&Y resulted in those clients having to restate their previously issued financial statements to make up for the departure from U.S. generally accepted accounting principles.

These companies — whose identity the PCAOB keeps confidential — had "failed" to fully follow FAS 48, Revenue Recognition When Right of Return Exists. The rule calls on companies to, at the time of sale, make reasonable estimates of how many products that customers will return as a factor in deciding when revenue can be recorded.

Further criticizing the audit firm for its work on a third client, the PCAOB claims E&Y didn't test the issuer's VSOE, or vendor-specific objective evidence, which is used to figure out whether the amount of revenue recognized for individual parts of a technology contract was reasonable.

The PCAOB noted the revenue recognition audit deficiencies mentioned here, as well as several others at eight of E&Y's clients after reviewing the firm's work between April and December of last year. The deficiencies were linked to the firm's national office in New York and 22 of its 85 U.S. offices. These errors were significant enough for the oversight board to conclude the firm "had not obtained sufficient competent evidential matter to support its opinion on the issuer's financial statements or internal control over financial reporting."

The PCAOB also criticized E&Y for not fully exploring a client's revenue contracts to see how their terms could affect the issuer's revenue recognition, for not doing enough work to assess the valuation of another issuer's securities, and for relying on information an issuer had deemed unreliable for estimating an income-tax valuation allowance.

To be sure, eight clients may not be many in terms of the number of audits looked at by the oversight board, or when taking into account that E&Y audits more than 2,300 publicly traded companies. The PCAOB, however, doesn't specify how many audits it reviewed and discourages readers of its inspection reports from drawing conclusion on a firm's performance based solely on the number of the reported deficiencies mentioned. "Board inspection reports are not intended to serve as balanced report cards or overall rating tools," the PCAOB notes.

For its part, E&Y, in all but two of the deficiencies cited, revisited its work and made changes. "Although we do not always agree with the characterization in the report ... in some instances we did agree to perform certain additional procedures or improve aspects of our audit documentation," E&Y wrote in a letter dated May 4, that was included in the PCAOB report.

Read the PCAOB report at http://www.pcaobus.org/Inspections/Public_Reports/2009/Ernst_Young.pdf

Bob Jensen's threads on Ernst & Young ---

http://www.trinity.edu/rjensen/fraud001.htm

Not for Accounting Amateurs

Tom's Mea Culpa and Some Good (Critical) Reasoning That Follows

"SAB 112: Let the New Earnings Game Begin," by Tom Selling, The

Accounting Onion, June 21, 2009 ---

http://accountingonion.typepad.com/theaccountingonion/2009/06/sab-112-let-the-new-earnings-game-begin.html

In a recent post on business combinations accounting that is related to SAB 112, I criticized the FASB for creating yet another loophole in business combinations accounting that make M&A transactions more attractive than they really should be. To recap, I described how JP Morgan wrote down toxic loans acquired from WaMu so that, going forward, JP Morgan had a built-in stream of future earnings at very high interest rates.

First, a Mea Culpa

I was feeling pretty satisfied with myself until reader Michael interrupted my reverie with several interesting and valid comments. With great reluctance, I began to re-think parts of my screed.

First of all, he found a couple of inaccuracies in my telling, which should be corrected:

"Tom, I think I'm with you on your conclusion (i.e. mark all financial assets to fair value (replacement cost?)) but the area of GAAP causing the inconsistent measurement is not FAS 141(R). FAS 141(R) was first effective for transactions that closed on or after 1/1/09 for calendar year companies. JPMorgan was subject to FAS 141 (no R) for this transaction and disclosed as such. However, you may be aware that even under FAS 141, certain loans were required to be accounted for at fair value, notwithstanding the SAB [Topic 2A-(5)]...those loans that were purchased at a significant discount are subject to the guidance in SOP 03-3, which requires a fair value measurement [at the acquisition date] for such loans. Given the purely awful composition of WaMu's portfolio, it is not surprising that half their loans fell into that guidance. I think most of the focus should be on the criminal allowance put up by WaMu pre-transaction...$2 billion on $240 billion in loans at 3/31/08, $8 billion on $240 at 6/30/08. Yikes." [italics and bolding supplied]

That's a really interesting last sentence, especially coming from an auditor, and I'm betting that even the PCAOB will not want to go near that one. As important as that may be, it's a digression from the mea culpa I now proffer to all who read that post: I overlooked the fact that SOP 03-3 would be applicable, because I mistakenly thought the acquisition of WaMu was accounted for under FAS 141(R).

Michael's comment and my mea culpa notwithstanding, the fact remains that henceforth, FAS 141(R) has taken over for SOP 03-3 in the earnings management toolbox when it comes to making sure that a business combination transaction will be accretive to future earnings. (Note: that doesn't mean that SOP 03-3 has become obsolete. Loan acquisitions that are not part of a business combination are also within its scope.)

Michael also responded to my suggestion that the offending provision of FAS 141(R) should be suspended until loans are fair valued. He pointed out that should that day ever come, the invitation for earnings management of which I spoke doesn't completely go away:

" … [L]et's assume that all financial instruments were remeasured each period at fair value. While there will be timing differences with loans that are measured at fair value at acquisition, net income over the life of the same loans will be the same...if JPMorgan had to continue to remark the loans, they'd still recognize that accretion into earnings if the loans ultimately perform. I understand your generally well founded skepticism, but I think this is one of the less offensive areas of FAS 141R.

Michael is right (again). I could live with an outcome whereby unbiased fair value measurements will provide a stream of accounting earnings to an acquiree. But, I am indeed more than a little skeptical that two versions of fair value will emerge from FAS 141(R)—if they haven't already from other games that executives will play with earnings. The WaMu's will still have strong incentives to overstate market value, and even Michael implies that auditors are not likely to stand in their way. The JP Morgans of the world have incentives to understate the same fair values.

Enter SAB 112

That's where SAB 112 comes into the discussion. Among other ministerial changes, it deleted Topic 2A-(5) of the SAB codification, which I described in the earlier post and became unnecessary after FAS 141(R) instituted the fair value requirement for acquired loans. The crux of this post is this: if the SEC thought that manipulation of loan loss reserves during a business combination merited an anti-abuse rule, then more than ministerial adaptations were called for. How can the SEC be so naïve as to think that fair value will fix the problem of loan value manipulation? Instead of merely deleting Topic 2A-(5), they should have re-written it to put the brakes on what will surely become a new recipe for chicken salad. It would have been really simple for the SEC to make the following rule:

Irrespective of pre- and post-acquisition bases of measurement, the new carrying amount of every asset recognized may be no less at the date of acquisition than the carrying amount recognized by the acquiree; similarly, the fair value of liabilities assumed may be no greater than amounts recognized by acquirees.

I know that my suggestion may sound unprinicpled and draconian to some (and I would be prepared to allow for some exceptions), but the reality is that no set of business combination accounting rules will be perfectly 'efficient.' For any accounting rule, it is inevitable that some value-creating transactions will be discouraged, and some value-destroying transactions will occur because the accounting result is too sweet to resist. The key for regulators is to strike an appropriate balance based on broadly acceptable objectives for financial reporting.

In regard to business combinations, there have been no such objectives ever before. It is clear that the rules have been completely out of whack since the inception of GAAP in the 1930s. As for the last few decades, the evidence is crystal clear that our economy has been administered a nearly lethal dose of value-destroying business combinations to juice executive compensation while killing share prices and wreaking havoc among rank and file employees. That's why I believe it is time to trying something more radical: an acquiror should not be able to create a stream of reported earnings by writedowns to assets or increases to liabilities. Therefore, post acquisition writedowns of assets and write-ups of liabilities would be charged against the post-combination earnings of the acquiror.

Let's see if the 'new SEC' is up to the task. We'll know they're doing it right if the EU and IASB have conniptions over it.

Bob Jensen's threads on fair value accounting are at

http://www.trinity.edu/rjensen/theory01.htm#FairValue

Video (humor?): Jon Stewart versus Jim Cramer (CNBC) on The Daily

Show ---

http://www.youtube.com/watch?v=Vi6bxKAAHzQ

See the full episode --- http://www.youtube.com/watch?v=dwUXx4DR0wo

Video: Financial Reporting in Today’s Economy - Buyouts, Takeovers,

Downsizing ---

http://www.simoleonsense.com/video-financial-reporting-in-todays-economy-buyouts-takeovers-downsizing/

The John Stewart & Jim Cramer battle made numerous rounds and yet the question still remains- should the financial media be held accountable for failing to warn citizens of the economic/financial downturn?

Introduction (Via Fora.TV)

Should financial media be held accountable for their failure to have warned the public of the current economic downturn? What steps are being taken to avoid this happening in the future?

A panel of leading financial reporters assess the global crisis and discuss the ‘perfect storm’ of events that led to it. Aspiring journalists will hear how to avoid the perils and pitfalls of the profession, and media observers can decide for themselves if the media is to blame.

About the Speaker (Via Fora.TV)

Liz Claman - Liz Claman joined FOX Business Network (FBN) as an anchor in October 2007. Her debut included an exclusive interview with Berkshire Hathaway CEO and legendary investor Warren Buffett.

Alan Murray - Alan Murray is a Deputy Managing Editor of The Wall Street Journal and Executive Editor for the Journal Online. He also has editorial responsibility for Wall Street Journal television, books, conferences, and the MarketWatch web site. Mr. Murray spent a decade as the Journal’s Washington bureau chief.

Jeff Bercovici - Jeff Bercovici joined Conde Nast Portfolio from Radar magazine, where he was part of the relaunch team for both the online and print editions.

Bob Jensen's threads on accounting theory and financial reporting are at

http://www.trinity.edu/rjensen/theory01.htm

Fiery Debate Over Fair Value Accounting

"The Fair-Value Deadbeat Debate Returns: On hiatus while other fair-value

questions were debated, the hotly-contested issue of why companies can book a

gain when their credit rating sinks has returned to center stage," by

Marie Leone, CFO.com, June 29, 2009 ---

http://www.cfo.com/article.cfm/13932186/c_2984368/?f=archives

A new discussion paper released last week by the staff of the International Accounting Standards Board has revived an old, but still fiery fair-value controversy.

At issue: the role of credit risk in measuring the fair value of a liability. According to the paper's opening statement: the topic has "arguably ... generated more comment and controversy than any other aspect of fair value measurement."

At the heated core of the dispute is the question of why accounting rules allow companies to book a gain when their credit rating actually sinks. The accounting convention, which opponents contend is counterintuitive if not ridiculous, has prompted "a visceral response to an intellectual issue," says Wayne Upton, the IASB project principal who authored the discussion paper.

For all the hubbub around it, the rule is rather simple: When a company chooses to use the fair value method of accounting, it must mark its liabilities as well as its assets to market. As a company's credit rating goes down, so does the price of its debt, which therefore must be re-measured by marking the liability to market. The difference between the debt's carrying value and its so-called fair value is then recorded as a debit to liabilities, and a credit to income.

Consider an oversimplified example to clarify the accounting treatment. A company records a $100 liability for a bond it has issued. Overnight, the company's credit rating drops from A to BB. That drop causes the price of the bond trading in the market to decrease from $100 to $90. The $10 difference, under current accounting rules, is recorded as a $10 debit to liabilities on the balance sheet and a $10 credit to income on the income statement.

As the company's credit rating and the price of the bond rise — to, say, $100 again — the accounting is reversed. Income takes a $10 hit, while the liability account is credited.

That accounting oddity has been a lingering problem since 2000, when the Financial Accounting Standards Board introduced Concept Statement 7, which includes a general theory on credit standing and measuring liabilities. The notion was hotly debated again in 2005, when IASB revised IAS 39, its measurement rule for financial instruments and in 2006 when FASB issued FAS 157, its fair-value measurement standard.

Addison Everett, the practice leader for global capital markets at PricewaterhouseCoopers, notes that the debate cooled down over the last 18 months as the liquidity crisis bubbled up. The crisis spotlighted more politically charged fair-value topics such as asset valuation in illiquid markets, classification of financial assets, asset impairment, and financial disclosures, he says.

But the credit risk quandary is back, demanding the attention of investors, regulators, and lawmakers who were carefully watching ailing financial institutions as they posted their first-quarter earnings results. As financial results were disclosed this year, it became clear that IAS 39 and FAS 157 were being used to boost income as banks and insurance companies became less creditworthy. For example, in the first quarter, Citigroup benefited from its credit rating downgrade by posting a $30 million gain on its own bond debt.

A Credit Suisse report looking back to last year, flagged a similar trend. The bank examined the first-quarter 2008 10-Qs of the 380 members of the S&P 500 with either November or December year-end closes, the first big companies to adopt FAS 157. For the 25 companies with the biggest liabilities on their balance sheets measured at fair value, widening credit spreads-an indication of a lack of creditworthiness-spawned first-quarter earnings gains ranging from $11 million to $3.6 billion.

Those keen on keeping the rules intact and allowing companies to book a gain when credit ratings worsen give several reasons for their stance. Most are laid out neatly in the IASB discussion paper. Consistency is one argument. "Accountants accept that the initial measurement of a liability incurred in an exchange for cash includes the effect of the borrower's credit risk," according to the paper. There's "no reason why subsequent current measurements should exclude changes."

There's a practical problem with that argument, however. Not all liabilities are financial in nature. Non-financial liabilities, such as those tied to plant closings (asset removal), product warranties, pensions, insurance claims, and obl igations linked to sales contracts, are not as easily marked to market as a clear-cut borrowing. Often non-financial liabilities represent a transaction with an individual counterparty that has already placed a price on the chance of not being repaid. For many of those liabilities, "accounting standards differ in their treatment of credit risk," notes the paper.

One cure is to use a risk-free discount rate for all liabilities in order to apply a consistent measurement approach. But applying a blanket discount rate to the initial measure of debt leaves accountants with the problem of what to do with the debit. That is, for financial liabilities, should the debit be treated as a borrowing penalty and therefore as a charge against earnings? Or should the debit be subtracted from shareholder's equity and amortized into earnings over the life of the debt? For non-financial debt, should the debit be the recognized warranty or plant-closing expense?

Continued in article

June 26, 2009 reply from walkerrb@ACTRIX.CO.NZ

This issue arose at the time of FASB's (brilliant) special report on using cash flow information in 1996. Between the time of the issue of the special report and the conceptual statement emanating from it, the position had changed. In the report, from memory, the position was the actuarially pure one in which both sides of the balance sheet were discounted at the same, risk free rate.

When the CS was issued in draft it had changed to the, arguably, actuarially invalid position that the balance sheet was discounted at different rates - assets would be at the risk free rate and liabilities at a rate reflecting the credit risk of the accounting entity.

At the time I found this to be bizarre. I have slowly changed my mind over the last decade. The apparent maintenance of actuarial purity across the balance sheet is actually an illusion. To apply the risk free rate to assets necessitates a significant degree of mathematical calculation prior to its application (see IAS 36 para 30). No such computation is necessary for liabilities.

Ultimately, it is best to look at the practical effects of which two are illustrative.

Firstly, the value of a liability should be the same as the value of the asset in the counter-party's records, being the creditor. The creditor would apply a process which would compute the credit risk premium from a probability analysis, being the spread, and then apply the risk free rate. All that is happening in debtor's accounting records is the mirror of this process. Intuitively this must be correct.

Second, I do recall many years ago being sent a case by a man named William (?) Hackney, a lawyer from Pittsburgh I think who wrote academic articles about the determination of corporate solvency and GAAP. (I have lost touch with him, does anybody know him?). The case involved TWA and its solvency. One side argued that the correct value of its liabilities for solvency purposes was its market value. Its debt traded at 50 cents in the dollar so its liabilities were 50% of its face value.

Dr Liability Cr Equity

with 50% of the value.

The other contestant in the matter claimed the liability should be face value.

I have lost my copy of the case but I think the discounter won. This makes a kind of perverse sense. One of the essential characteristics of a liability is that it results in an outflow of funds. A company with an asset costing $100 fully funded by a liability where that asset fetches only $25 will only cause an outflow of funds to $25. That must be the value of the liability therefore.

Where this becomes perverse is that a company is never insolvent because as it falls into the abyss its liabilities erode in the same proportion to the erosion of its assets. In insolvency law this becomes extremely problematic as insolvency is the determinant of civil or criminal sanction or penalty.

Bob Jensen's threads on fair value accounting are at

http://www.trinity.edu/rjensen/theory01.htm#FairValue

The FASB Probably Won't Care for this

Teaching Case

But it provides good input for

student debates on fair value accounting

In fairness, the FASB contends that the what bankers claim is a major change

in FAS 157 really is a cosmetic change that wasn't truly needed but is no big

deal if it makes bankers happy. If the banks really wanted to bypass Level 1 and

2 fair value estimation, they could've moved to Level 3 all along without the

rule change. Whatever the reasons or excuses, banks with toxic loan portfolios

can now report higher earnings that have little to do with higher cash flows

(unless the cash is rolled in from TARP bailout loans and gifts is reduced

because gullible investors are relying on phony bank earnings reports). Sadly,

the European Union is now bringing similar pressures to bear on IFRS fair value

accounting.

Personally, I thought the blaming fair value accounting standards by Bill

Isaac and his billionaire friends (Warren Buffet and Steve Forbes) for the bank

failures was a pile of crap ---

http://www.trinity.edu/rjensen/2008Bailout.htm#FairValue

The banks failed because of dysfunctional mortgage lending policies that

encouraged fraud, dysfunctional performance compensation schemes that encouraged

bankers to cheat shareholders, and too much reliance on David Li's flawed

Gaussian copula function ---

http://www.trinity.edu/rjensen/2008Bailout.htm

The frauds were exacerbated by unprofessional CPA auditing firms and credit rating agencies that were anything but independent of the clients that paid their fees --- http://www.trinity.edu/rjensen/2008Bailout.htm#AuditFirms

Sadly, the bankers want to blame fair value accounting standards for the the collapse of their system. This is like blaming Hans Brinker for having such a small finger in in a Holland dike.

From The Wall Street Journal Weekly Accounting Review on June 4, 2009

Congress Helped Banks Defang Key Rule

by Susan Pulliam and Tom McGinty

The Wall Street Journal

Jun 03, 2009

Click here to view the full article on WSJ.com ---

http://online.wsj.com/article/SB124396078596677535.html?mod=djem_jiewr_ACTOPICS: Accounting For Investments, Advanced Financial Accounting, Banking, Fair Value Accounting, Fair-Value Accounting Rules, Financial Accounting Standards Board, Financial Reporting

SUMMARY: This article reports on a WSJ investigation into lobbying of, and contributions to, members of the House Financial Services subcommittee. "Earlier this year...thirty-one financial firms and trade groups formed a coalition and spent $27.6 million in the first quarter lobbying Washington about [changing the FASB's fair value] rule and other issues, according to a Wall Street Journal analysis of public filings. They also directed campaign contributions totaling $286,000 to legislators on a key committee, many of whom pushed for the rule change, the filings indicate." The FASB ultimately responded to pressure by issuing a staff position on April 9, 2009 allowing financial institutions to use greater judgment in determining market values when markets show evidence of illiquidity and signs of being disorderly than was originally included in Statement 157. "The American Bankers Association (ABA)...acknowledges that it exerted pressure to change the rules. The ABA was the biggest donor to the campaign funds of committee members in the weeks before the hearing. It gave a total of $74,500 to 33 members of the committee in the first quarter, according to the Journal analysis of public filings. An ABA spokesman says that is its normal level of support for lawmakers, and that the initiative was part of a broader effort to change accounting rules....We worked that hearing," says ABA President Edward Yingling. "We told people that the hearing should be used to talk about the big problems with 'mark to market,' and you had 20 straight members of Congress, one after another, turn to FASB and say, 'Fix it.'"

CLASSROOM APPLICATION: This article shows the political nature of the accounting standards setting process. It also shows how the press can obtain information and conduct analyses to keep interested individuals aware of the process. In this case, the interested individuals include investor groups who feel that the accounting changes watered down the fair value reporting standards.

QUESTIONS:

1. (Introductory) In general, what are the requirements established in FASB Statement No. 157, Fair Value Measurements? Hint: you may access this FASB document on their web site at http://www.fasb.org/st/

2. (Introductory) What changes were implemented with FASB Staff Position (FSP) 157-4? Again, you may access the document at http://www.fasb.org/st/

3. (Introductory) In general, what is the usual process for establishing authoritative accounting literature?

4. (Advanced) How did the U.S. political process influence this change in accounting requirements under fair value reporting? What are the concerns with the usual process for establishing accounting standards?

5. (Advanced) As reported in this article, who is displeased with this change in financial reporting requirements? Are their concerns limited to whether the appropriate accounting requirements have been set?

6. (Advanced) What do you think about having our elected officials in Congress, influence the process of establishing accounting standards?Reviewed By: Judy Beckman, University of Rhode Island

"Congress Helped Banks Defang Key Rule," Susan Pulliam and Tom McGinty, The Wall Street Journal, June 3, 2009 --- http://online.wsj.com/article/SB124396078596677535.html?mod=djem_jiewr_AC

Not long after the bottom fell out of the market for mortgage securities last fall, a group of financial firms took aim at an accounting rule that forced them to report billions of dollars of losses on those assets.

Marshalling a multimillion-dollar lobbying campaign, these firms persuaded key members of Congress to pressure the accounting industry to change the rule in April. The payoff is likely to be fatter bottom lines in the second quarter.

The accounting issue lies at the heart of the financial crisis: Are the hardest-to-value securities worth no more than what the market is willing to pay, or did the market grow too dysfunctional to properly set values?